Earlier this week, the Parkland Institute released a report that I contributed to, entitled Thumb on the scale: Alberta government interference in public-sector bargaining.

This report examines how, in a time when workers’ Charter-protected associational rights appear to be expanding, the rate at which governments interfere with collective bargaining has skyrocketed.

It specifically looks at Alberta’s ongoing use of secret bargaining mandates, which turn public-sector bargaining into a hollow and fettered process.

This report is relevant because both UNA and AUPE have exchanged opening proposals with the government in the last few weeks and will be bargaining against secret mandates. The government opener in both cases was, unsurprisingly, identical and there is a huge gap between what workers are asking for and what the government is offering.

-- Bob Barnetson

Labour & Employment in Alberta

Examining contemporary issues in employment, labour relations and workplace injury in Alberta.

Friday, February 23, 2024

Friday, January 12, 2024

New research on unions' impact on wages and benefits

In November, Andrew Stevens and Angele Poirier released a report that examined the union effect on wages and benefits across Canada to 2022, with the data for Saskatchewan also broken out.

Nationally, unionized workers earned an average of 11% more than non-unionized workers. There was significant provincial, gender, age, and sectoral variation. The union advantage appeared particularly pronounced for workers aged 15 to 24 (+26%) and part-time workers (+41%).

Unionized workers were also more likely to have paid sick time (80% versus 555 for nonunionized). Unionized workers were also much more likely to have employment-related pension plans (825 versus 37%) as well as other supplementary benefits.

Interestingly, non-unionized workers experienced slightly higher wage increases between 2020 and 2022. This might reflect pressure on non-union employers to improve wages in order to attract and retain staff (i.e., is a union spill-over effect). It might also reflect that union contracts (which fix compensation for a period of time) may delay increases (e.g., inflationary bumps) or unionized workers (who are very often in the public sector) may have been subject to mandated wage freezes and rollbacks by the state.

-- Bob Barnetson

Nationally, unionized workers earned an average of 11% more than non-unionized workers. There was significant provincial, gender, age, and sectoral variation. The union advantage appeared particularly pronounced for workers aged 15 to 24 (+26%) and part-time workers (+41%).

Unionized workers were also more likely to have paid sick time (80% versus 555 for nonunionized). Unionized workers were also much more likely to have employment-related pension plans (825 versus 37%) as well as other supplementary benefits.

Interestingly, non-unionized workers experienced slightly higher wage increases between 2020 and 2022. This might reflect pressure on non-union employers to improve wages in order to attract and retain staff (i.e., is a union spill-over effect). It might also reflect that union contracts (which fix compensation for a period of time) may delay increases (e.g., inflationary bumps) or unionized workers (who are very often in the public sector) may have been subject to mandated wage freezes and rollbacks by the state.

-- Bob Barnetson

Labels:

collective bargaining,

HRMT208,

HRMT326,

HRMT386,

IDRL316,

labour relations,

LBST200,

pensions,

research,

statistics,

unions,

wages

Thursday, December 14, 2023

Disaster responses, OHS and COVID

One of many tasks of OHS practitioners is to plan organizational responses to disasters. The most common kind of workplace disaster we develop plans for are building fires. In fact, the laws passed in the wake of the Triangle Shirtwaist Fire are some of the earliest forms of OHS regulation.

In planning a response to a fire (hint: get out), it can be useful to know how people respond to rapidly evolving, high-stress, low-frequency events and why they respond that way. Last week, I ran across a 2004 article entitled “Why people freeze in an emergency: Temporal and cognitive constrains on survival responses”

Basically, the author looked at the literature, examined disaster inquiry reports, and interviewed a bunch of disaster survivors to verify the existence of freezing behaviour in disasters and quantify it. He concluded:

This finding is important because, generally speaking, the mechanisms we create to allow people to protect or save themselves in such situations requires them to take immediate and sensible action (e.g., use fire exits, put in a life vest, open an emergency exit on a plane). If only 10-15% of people can be relied upon to do so, then these mechanisms likely won’t achieve their desired result (i.e., nobody dies).

The author attempts to explain maladaptive emergency behaviour by conjecturing that sub-optimal responses are related to our brains’ information-processing limitations. He asserts that, when faced with a novel event, our brain requires time to assess it, develop a plan, and execute it.

Disasters, which are novel and complex and involve significant stress, often unfold too quickly for us to meaningfully react. However, he says, since your brain can select among a pre-existing behaviours much faster than it can design new behaviours, training on how to respond can attenuate this effect. (This is why we do fire drills and why you get a safety briefing before every time a plane takes off.)

The explanation advanced by this article has intuitive appeal (i.e., it sounds plausible on first blush), but the question is whether the explanation is correct. Recall that the conclusion (i.e., brain too slow) is conjecture, rather than the results of any empirical testing. I spent some time looking for evidence that this conjecture was correct and didn’t find much (although this isn’t my field and maybe I looked in the wrong places; I also ran into a bunch of paywalls that I could not get past).

What I found was:

The reason this article came up in my feed (I think on Bluesky but maybe Twitter) is that someone was likening the three-group typology to explain people’s reactions to Covid. Basically the asserted that the calm, muddled, and counterproductive groups in the 2004 disaster study are analogous to active avoiders, passive avoiders, and minimizers.

This analogy was intuitively appealing, bolstered by the seeming authority of the original study. It is useful, though, to deliberate a bit about whether the disasters that the original article looked at (e.g., a ferry sinking or a plane catching fire) is similar enough to Covid for conjectured explanation to apply. A key difference that jumps almost immediately to mind is the time scale.

Contemporary Covid behaviours are the result of a lengthy process. While Covid is a novel event, the time-scale is not the same as the disasters that the original author explored (where the speed of the disaster may have outpaced decision making).

So, while the proportion of active avoiders, passive avoiders, and minimizers may (or may not) mirror the groupings in the disaster study, the similarities between disasters and Covid are likely superficial and coincidental. Thus, we ought not put much stock in the claim that the 2004 study is in any was applicable or instructive to understanding Covid responses.

-- Bob Barnetson

In planning a response to a fire (hint: get out), it can be useful to know how people respond to rapidly evolving, high-stress, low-frequency events and why they respond that way. Last week, I ran across a 2004 article entitled “Why people freeze in an emergency: Temporal and cognitive constrains on survival responses”

Basically, the author looked at the literature, examined disaster inquiry reports, and interviewed a bunch of disaster survivors to verify the existence of freezing behaviour in disasters and quantify it. He concluded:

Responses to unfolding disaster can be divided broadly into three groups.

In the first group, between 10‐15% of people will remain relatively calm. They will be able to collect their thoughts quickly, their awareness of the situation will be intact, and their judgment and reasoning abilities will remain relatively unimpaired. They will be able to assess the situation, make a plan, and act on it.

The second group, comprising approximately 75% of the population, will be stunned and bewildered, showing impaired reasoning and sluggish thinking. They will behave in a reflexive, almost automatic manner.

The third group, comprising 10‐15% of the population, will tend to show a high degree of counterproductive behavior adding to their danger, such as uncontrolled weeping, confusion, screaming, and paralyzing anxiety (Leach, 2004).

This finding is important because, generally speaking, the mechanisms we create to allow people to protect or save themselves in such situations requires them to take immediate and sensible action (e.g., use fire exits, put in a life vest, open an emergency exit on a plane). If only 10-15% of people can be relied upon to do so, then these mechanisms likely won’t achieve their desired result (i.e., nobody dies).

The author attempts to explain maladaptive emergency behaviour by conjecturing that sub-optimal responses are related to our brains’ information-processing limitations. He asserts that, when faced with a novel event, our brain requires time to assess it, develop a plan, and execute it.

Disasters, which are novel and complex and involve significant stress, often unfold too quickly for us to meaningfully react. However, he says, since your brain can select among a pre-existing behaviours much faster than it can design new behaviours, training on how to respond can attenuate this effect. (This is why we do fire drills and why you get a safety briefing before every time a plane takes off.)

The explanation advanced by this article has intuitive appeal (i.e., it sounds plausible on first blush), but the question is whether the explanation is correct. Recall that the conclusion (i.e., brain too slow) is conjecture, rather than the results of any empirical testing. I spent some time looking for evidence that this conjecture was correct and didn’t find much (although this isn’t my field and maybe I looked in the wrong places; I also ran into a bunch of paywalls that I could not get past).

What I found was:

- An article entitled Executive Dysfunction in a Survival Environment (2010) saw the author explore in more detail which aspects of executive functioning were impaired by novel and stressful conditions. It finds some support for the conjecture.

- An paper entitled Startle, Freeze and Denial: An analysis of Pathological Pilot Reactions during Unexpected Events (2012) explored multiple potential explanations for maladaptive behaviour, suggesting more complex dynamics.

The reason this article came up in my feed (I think on Bluesky but maybe Twitter) is that someone was likening the three-group typology to explain people’s reactions to Covid. Basically the asserted that the calm, muddled, and counterproductive groups in the 2004 disaster study are analogous to active avoiders, passive avoiders, and minimizers.

This analogy was intuitively appealing, bolstered by the seeming authority of the original study. It is useful, though, to deliberate a bit about whether the disasters that the original article looked at (e.g., a ferry sinking or a plane catching fire) is similar enough to Covid for conjectured explanation to apply. A key difference that jumps almost immediately to mind is the time scale.

Contemporary Covid behaviours are the result of a lengthy process. While Covid is a novel event, the time-scale is not the same as the disasters that the original author explored (where the speed of the disaster may have outpaced decision making).

So, while the proportion of active avoiders, passive avoiders, and minimizers may (or may not) mirror the groupings in the disaster study, the similarities between disasters and Covid are likely superficial and coincidental. Thus, we ought not put much stock in the claim that the 2004 study is in any was applicable or instructive to understanding Covid responses.

-- Bob Barnetson

Monday, November 20, 2023

Bill 5 continues government interference in collective bargaining

Canada has a long tradition of governments using their power as legislators to give themselves a further advantage in their role as an employer. This is called permanent exceptionalism. Basically, governments pass laws undermining public-sector workers’ bargaining power, justifying them as temporary and exceptional interventions, except they are neither.

My colleagues Jason Foster and Susan Cake and I published a study of legislative interventions in labour relations from 2000 to 2020 in a recent issue of the Canadian Labour & Employment Law Journal (vol 25, issue 1) called “Catch me if you can”: Changing forms of permanent exceptionalism in response to Charter jurisprudence.”

The upshot is that, during a time when the Supreme Court was finding that workers’ associational rights in the Charter included the right to collectively bargain and strike free from substantial interference, the rate of government interference significantly increased (tripling over the 1990s). Basically, governments have become addicted to rigging the game against public-sector workers.

Back in 2019, Alberta’s UCP government passed the Public Sector Employers Act. The PSEA allowed the government to give public-sector employers secret and binding bargaining mandates. This made the 2020 round of public-sector bargaining a hollow and fettered process (our study about this is currently in review) and let the government drive home a combination of wage freezes, miserly wage increases, and other rollbacks. This built upon a similar strategy use by the NDP government in the 2017 round of bargaining that also delivered several years of wage freezes.

Presently, the legislature is debating Bill 5, which amends the PSEA. The headlines around this Act have focused on how the government will be better able to attract certain types of public-sector workers (i.e., wages are too low) while also now controlling the wages for non-unionized workers via secret bargaining directives. In the house, the NDP is flagging how Bill 5 opens the door to pork-barrelling for public-sector CEOs.

Almost no one is examining how Bill 5 extends the original secret mandate powers. The new bill allows the government to create employer committees and associations to coordinate (and perhaps perform) bargaining, potentially on sector-wide bases. This is pretty much how it works at the big tables in education, health-care, and the core civil service now.

But, for the 250-odd bargaining tables among agencies, boards, and commissions, these amendments would allow for big changes. In theory, employers could bargain cooperatively against dozens and dozens of disparate small unions and union locals, each bargaining on their own. Combined with an inflexible government mandate, this would make it very hard for these workers to get a decent deal and would make it much easier for the government (via these employers) to drive further concessions into these contracts. There are no similar provisions for sectoral bargaining arrangements for workers.

Alberta is already suffering from significant staffing shortages in health-care and education. Further grinding wages and hollowing out of public sector-bargaining (combined with the government threatening to take control of Albertan’s Canada Pension Plan contributions and its efforts to grab up public-sector pensions) will make Alberta an unattractive place for new graduates to stay.

-- Bob Barnetson

Labels:

collective bargaining,

IDRL215,

IDRL309,

IDRL316,

IDRL320,

labour relations,

public policy,

unions

Wednesday, October 18, 2023

Alberta Labour 2023 Annual Report

Alberta has released its 2023 annual report for the part of the government that was at one time called Labour and that relate to Albertans being safe and treated fairly in the workplace.

Fairness at Work Declines

The number of employment standards complaints filed were up by about a third in 2022/23. Complaints tend to reflect a fraction of overall violations; most workers don’t bother reporting things like wage theft.

This is an interesting reversal of a long-term decline in employment standards complaints.

Notably, the time to begin an investigation tripled and the time to resolve a complaint doubled. This has long been a bugbear in the employment standards system. The report asserts this reflects increasing volume and complexity.

The number of complaints investigated with signs of human trafficking jumped from 102 in 2021/22 to 208 in 20223/23.

The number of administrative penalties issued to employers dropped from 3 in 2021/22 to zero in 2022/23.

Safety: Losing the Will to Enforce

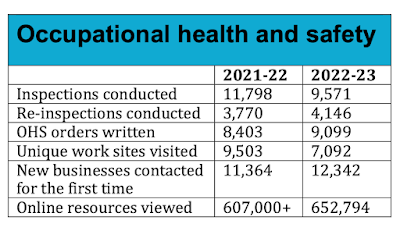

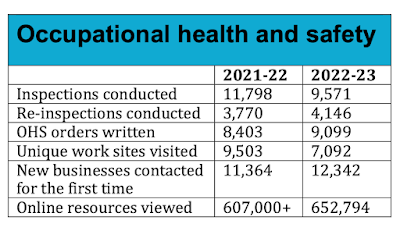

Worksite inspections plus re-inspections totalled 13,717 in 2023/23, down 12% from 15,569 in 2021/22. If you look later in the report for some context, this is about 6% fewer inspections/re-inspections than in 2018/19 (14,590), which was the last full year when the NDs were in power. At this rate, the inspection cycle is theoretically about once every 15 years (give or take).

About 80% of inspections were the results of complaints while the remaining 20% were targeting industries with safety problems. There were 1207 proactive inspections in 2022/23 resulting in 1725 orders issued. This is down from 2021/22, with 2100 inspections and 2548 orders. I couldn't find any historical data in this to provide context.

The number of investigations (e.g., of injuries) dropped by 60%, from 2245 in 2018/19 to 888 in 2022/23.

Orders written were up slightly over 2021/22 to 9099. This may be good (more enforcement) or may be bad (more violations occuring)—hard to say. If you look at 2018/19, there were 16,680 orders issued.

Ticketing of violators was down. There were 27 tickets with a total value of $11,280 issued in 2022/23. This is slightly fewer than in 2021/22 (32 tickets, $11,500). This reporting leaves out important context. If you look at 2018/19, there were 479 tickets issued.

Administrative penalties were also down. There were 17 penalties worth $62,025 issued in 2022/23. This is notably fewer than in 2021/22 (37, $314,250).

Convictions were also down, with 2022/23 seeing $1,740,750 in fines assessed. This is down from $1,919,000 in 2021/22. There was no reporting of the number of convictions but a hand count suggests the number is stable the last few years at around (hand-waggle) 10 per year, down from more than 20 in 2018/19.

Injury Rates are Up: Yeah, it’s mostly COVID.

The lost-time claim rate rose for at least the seventh straight year. Much, but not all, of this increase is due to COVID-19 injuries.

The disabling injury rate (lost-time plus modified work) is also up. Again, much but not all of the increase is due to COVID injuries.

The absence of meaningful government protocols related to aerosol spread put responsibility for these COVID-related increases squarely on the shoulders of government.

Interestingly, the absolute number of accepted fatalities is down to 120 (from 136). There is no real analysis of that change. It could be the result of changes in the workforce composition. It could also just be random variation (small numbers tends to be swingy).

Analysis

Overall, it looks like the government continues to lose the will and/or capacity to meaningfully enforce workplace safety rules under the UCP. Not surprisingly, the rate of injury has risen, likely because workplaces are more dangerous.

There has also been an uptick in complaints about employment standards (basically wage theft). This could be caused by more workers knowing to and being willing to come forward. I’d guess, though, that this reflects employers knowing it is open-season on workers under the UCP and, thus, stealing wages more frequently.

-- Bob Barnetson

Fairness at Work Declines

The number of employment standards complaints filed were up by about a third in 2022/23. Complaints tend to reflect a fraction of overall violations; most workers don’t bother reporting things like wage theft.

This is an interesting reversal of a long-term decline in employment standards complaints.

Notably, the time to begin an investigation tripled and the time to resolve a complaint doubled. This has long been a bugbear in the employment standards system. The report asserts this reflects increasing volume and complexity.

The number of complaints investigated with signs of human trafficking jumped from 102 in 2021/22 to 208 in 20223/23.

The number of administrative penalties issued to employers dropped from 3 in 2021/22 to zero in 2022/23.

Safety: Losing the Will to Enforce

Worksite inspections plus re-inspections totalled 13,717 in 2023/23, down 12% from 15,569 in 2021/22. If you look later in the report for some context, this is about 6% fewer inspections/re-inspections than in 2018/19 (14,590), which was the last full year when the NDs were in power. At this rate, the inspection cycle is theoretically about once every 15 years (give or take).

About 80% of inspections were the results of complaints while the remaining 20% were targeting industries with safety problems. There were 1207 proactive inspections in 2022/23 resulting in 1725 orders issued. This is down from 2021/22, with 2100 inspections and 2548 orders. I couldn't find any historical data in this to provide context.

The number of investigations (e.g., of injuries) dropped by 60%, from 2245 in 2018/19 to 888 in 2022/23.

Orders written were up slightly over 2021/22 to 9099. This may be good (more enforcement) or may be bad (more violations occuring)—hard to say. If you look at 2018/19, there were 16,680 orders issued.

Ticketing of violators was down. There were 27 tickets with a total value of $11,280 issued in 2022/23. This is slightly fewer than in 2021/22 (32 tickets, $11,500). This reporting leaves out important context. If you look at 2018/19, there were 479 tickets issued.

Administrative penalties were also down. There were 17 penalties worth $62,025 issued in 2022/23. This is notably fewer than in 2021/22 (37, $314,250).

Convictions were also down, with 2022/23 seeing $1,740,750 in fines assessed. This is down from $1,919,000 in 2021/22. There was no reporting of the number of convictions but a hand count suggests the number is stable the last few years at around (hand-waggle) 10 per year, down from more than 20 in 2018/19.

Injury Rates are Up: Yeah, it’s mostly COVID.

The lost-time claim rate rose for at least the seventh straight year. Much, but not all, of this increase is due to COVID-19 injuries.

The disabling injury rate (lost-time plus modified work) is also up. Again, much but not all of the increase is due to COVID injuries.

The absence of meaningful government protocols related to aerosol spread put responsibility for these COVID-related increases squarely on the shoulders of government.

Interestingly, the absolute number of accepted fatalities is down to 120 (from 136). There is no real analysis of that change. It could be the result of changes in the workforce composition. It could also just be random variation (small numbers tends to be swingy).

Analysis

Overall, it looks like the government continues to lose the will and/or capacity to meaningfully enforce workplace safety rules under the UCP. Not surprisingly, the rate of injury has risen, likely because workplaces are more dangerous.

There has also been an uptick in complaints about employment standards (basically wage theft). This could be caused by more workers knowing to and being willing to come forward. I’d guess, though, that this reflects employers knowing it is open-season on workers under the UCP and, thus, stealing wages more frequently.

-- Bob Barnetson

Labels:

government,

health,

HRMT322,

IDRL308,

injured workers,

injury,

safety,

statistics,

WCB

Tuesday, October 17, 2023

John Oliver on Union Busting

A friend sent me this clip of John Oliver exploring union busting in the United States.

Very applicable to Canada as well.

-- Bob Barnetson

Labels:

class,

collective bargaining,

HIST336,

IDRL215,

IDRL316,

IDRL320,

labour relations,

LBST200,

political economy,

strikes,

unions,

videos

Tuesday, October 3, 2023

Climate change and safety: treeplanters and wildfire smoke

A few weeks back, the Tyee ran a story on the effect of increasing levels of wildfire smoke on tree planter OHS. This story is interesting because it looks at the effect of climate change on worker safety.

There are several reasons why this particular hazard and worker group are worth examining:

By contrast, Oregon and California require air quality monitoring and the availability of respirators when air quality gets to a specific point. This doesn’t mean these controls are adequate, but they are at least something.

-- Bob Barnetson

There are several reasons why this particular hazard and worker group are worth examining:

- Intensity of exposure: Tree planters often work in close proximity to wildfires and their work is physically demanding (increasing respiration and heart rate). Consequently, they are likely to have one of the highest intensities of exposure to wildfire smoke.

- Duration of exposure: In addition to long working days, most tree planters live in camps (e.g., tents) and lack any respite from the smoke in their off hours. This means these workers have a much longer duration of exposure than, say, a worker who might face dust in the workplace but then go home to clean air at the end of the day.

- Lack of specific controls or OELs: There are no specific occupational exposure limits (OELs) for wildfire smoke and general OELs for dust were not designed with wildfire smoke (which has very tiny particles) in mind.

- Latency: Injuries due to inhalation often have long latency periods and murky causality, thus the link between the work exposure and the ill-health can be hard to see.

- Proxy for nonworkers: The exposures experienced by tree planters can be useful in predicting larger population effects caused by increased wildfire effects (essentially the dangerous working conditions experienced by these workers create a natural experiment).

- Compliance: PPE slows tree planting work. Tree planters are generally paid on piece-rate basis. This pay structure basically forces tree planters to trade off their own health against their need to earn an adequate income and almost certainly reduces compliance. Contractors also have production targets, which means they too have an incentive to trade worker safety for profit.

By contrast, Oregon and California require air quality monitoring and the availability of respirators when air quality gets to a specific point. This doesn’t mean these controls are adequate, but they are at least something.

-- Bob Barnetson

Subscribe to:

Posts (Atom)